Connective broker resources

Find out the latest news and information from Connective

How can RateSetter help you and your customers?

March 19th, 2018

How can RateSetter help you and your customers?

RateSetter is a solutions focused lender offering a great range of personal loan products, competitive rates and quick turnaround times. You can find out more about RateSetter’s rates and products in BOLT, where you can lodge your applications fast! If you prefer, you can also get a direct accreditation with RateSetter – whatever works best for your business.

RateSetter offers you:

- 24 hour approvals on quality applications.

- A wide range of personal loan products for a variety of uses.

- Rates starting as low as 3.7% pa

- Personalised assistance with your scenarios, and more.

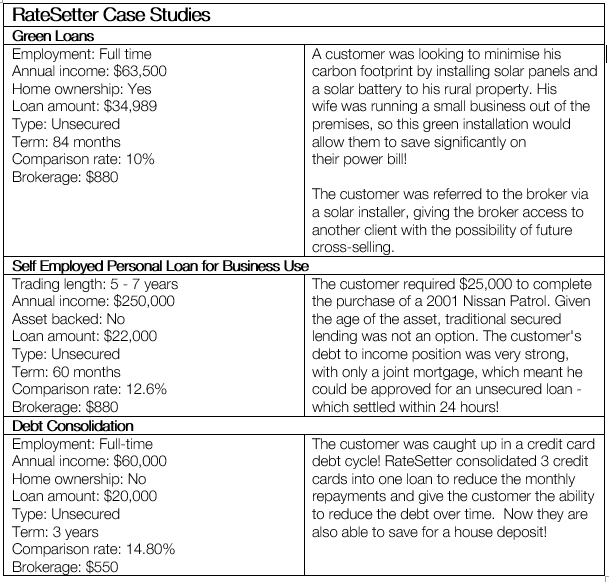

RateSetter has provided us with some great case studies and tips for brokers to show you how you can use their products to help your clients in a variety of situations. Check them out below.

Tips for brokers

Don’t throw personal loan leads away. It takes just 1 minute to see if your customer qualifies to apply for a RateSetter low-rate personal loan!

Qualify your customer over the phone. Brokers who complete the RateEstimate on behalf of the customer, rather than simply sending them the RateEstimate link, are twice as likely to settle a loan.

Call them! RateSetter’s dedicated broker team is available on 1300 889 332 Monday to Friday to answer your questions and to make your life easier!

Want to find out more?

Talk with your local Broker Support Manager or your Connective Asset Finance BDM. Call Steve Light BDM for VIC/SA/WA on 0499 399 433 or email stephen.light@connective.com.au or call Phillip Meehan BDM for NSW/QLD on 0488 788 839 or email him at phillip.meehan@connective.com.au

Want a direct accreditation? Call RateSetter BDM Belinda Mackey 0417 057 175.