Connective broker resources

Find out the latest news and information from Connective

Put your customers on the fast-track to debt reduction.

May 27th, 2019

Want to help your customers reduce their debts or pay off their home loan sooner? Offering your customers ways to free up their money to spend on other things or invest in property to build wealth for the future, is a great way to increase both customer loyalty and referrals!

Connective Home Loans (CHL) Select funded by Adelaide Bank, is our latest white label product range designed to give you a point of difference with your customers. It lets you package financial products and include special loan features to help your customers manage money more effectively and potentially reduce the overall interest they need to pay.

A CHL Select Package has the potential to save your customers a substantial amount of money and help them reduce their debt quicker. Here’s how.

Talk to them about a 100% Offset Account

As you probably know already, an offset account can potentially save your customers thousands over the life of their loan. Few white label home loan products offer a genuine 100% mortgage offset account, so CHL Select can really help you stand out from the crowd.

CHL Select gives you this option to offer your clients – even on fixed rate loans. Customers can put all their income into their offset account and maximise the home loan interest savings every month – and still use the funds as needed. It’s the ideal facility to put their salary into, if they want their money to work hard and reduce the compounding interest on their home loan. Find out more here.

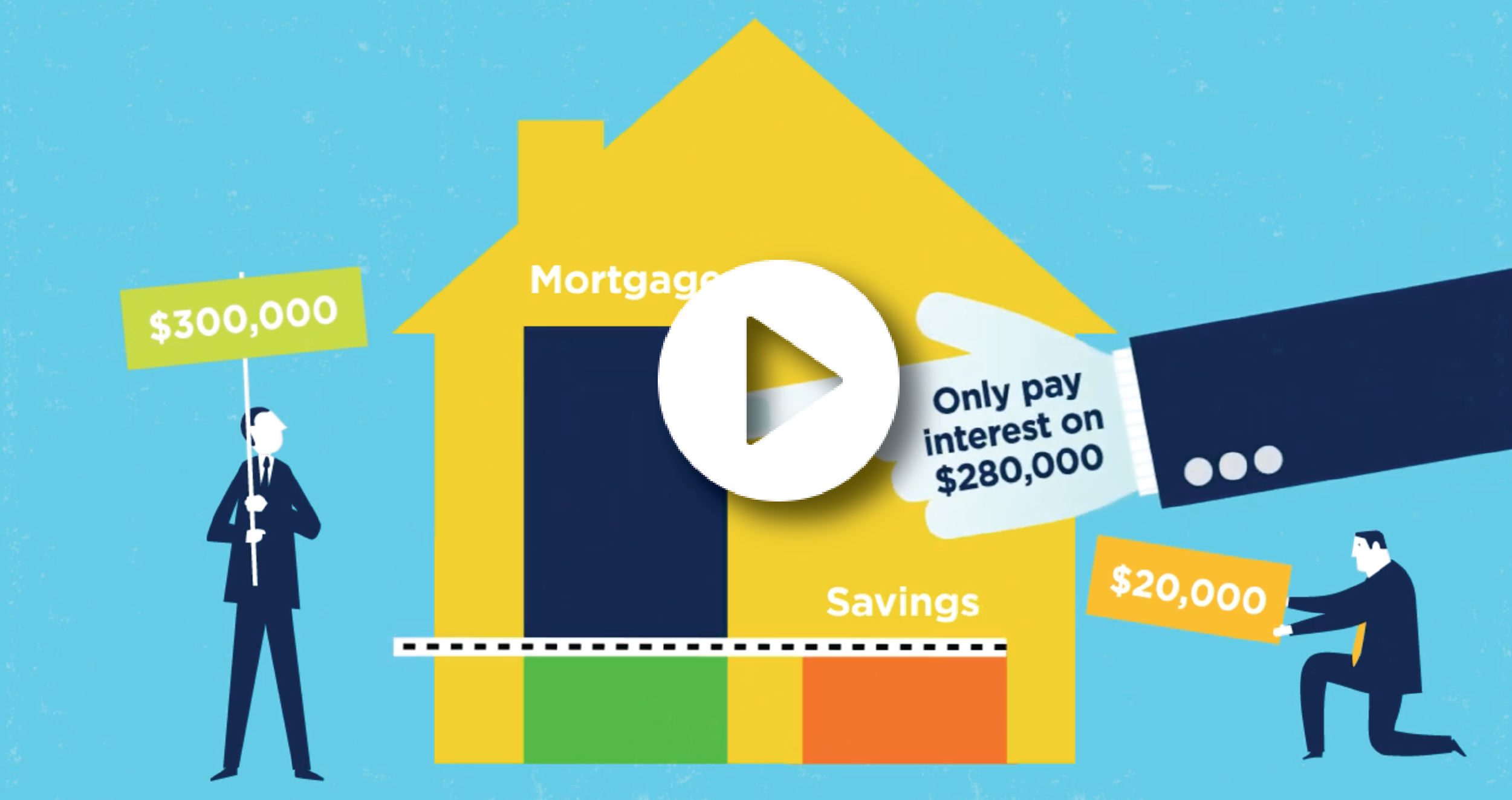

Watch this short video to find out how an offset account saving works.

They could make additional repayments – even on fixed rate home loans

In addition to the offset account, giving your customers the option of making additional payments on their home loan without penalty, could be another great differentiator for you and your business.

For example, a CHL Select fixed rate home loan gives your customers the ability to make extra repayments up to $20,000* a year. What’s more, if your customer wants to re-fix their rate at the end of their fixed rate term, there’s no additional charge with CHL Select.

CHL Select Visa Card

Money management is a key factor in debt reduction strategies. CHL Select products come with the benefit of a low interest Visa Credit Card to make that easier. What’s great about this option is that the CHL Select Offset Account can be set up with an automatic Visa Balance Sweep from their offset home loan account to their Select Visa every month, so your client never pays any interest or late payment fees. Features include:

- A competitive interest rate of just 9.99% p.a.

- 55 days interest-free credit on purchases.

- No annual fee* if purchases reach $12,000 p.a.

CHL Select customers can also access online banking facilities, ATMs, EFTPOS, Bpay®, Anypay and Bank@Post(TM) at no additional charge. Find out more here.

Interested in adding CHL Select to your customer offer?

Simply register for a CHL Accreditation Workshop near you here. We’ve made the accreditation process fast and easy, so you can start helping your clients get on the fast track to debt reduction sooner.

Already accredited with CHL Select? That’s great! If you have a deal ready to go or want to discuss a scenario then feel free to contact our friendly Connective Home Loans team on 1800 762 053.

*T&Cs and the usual lender criteria, application and approval processes apply to all these products. Please see our product brochures for all the details, or email info@connectivehomeloans.com.au if you have any questions.