Connective broker resources

Find out the latest news and information from Connective

ANZ Asset Finance Pricing & Commission Changes

November 27th, 2017

Pricing and Commission Changes that will affect ANZ Consumer Asset Finance Products.

Following ASIC’s review of flex commission arrangements in the car finance industry, ANZ has reviewed the way it prices consumer asset finance transactions. ANZ will introduce a number of changes to its pricing and commission plans for consumer asset finance products across all motor vehicle and other goods categories, effective from 1 December 2017.

What is changing?

- ANZ will be replacing the Base Rate with a Consumer Customer Rate, notified to the broker (monthly). The Consumer Customer Rate will be the maximum annual percentage interest rate that may be charged to a customer under a consumer asset finance loan.

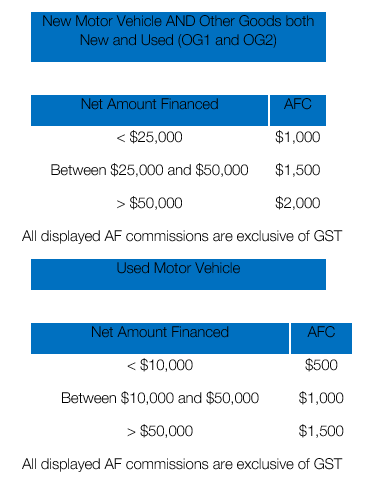

- The broker will be eligible for an AF commission (AFC) based on the tables below.

- The broker will have the discretion to discount the Consumer Customer Rate by a maximum of 200bps. The AFC to which the broker will be entitled for a particular transaction will be reduced in proportion to any discount to the Consumer Customer Rate (calculated in accordance with the formula below). Any discount of the Consumer Customer Rate by 200bps or more will result in the broker receiving zero commission.

- Consumer Other Goods will have two categories:

- Other Goods Category 1 (OG1) – Example: Caravans/Trailer and Marine

- Other Goods Category 2 (OG2) – Example : Motorcycles and Jet skis

- Consumer transactions must be submitted on the consumer pricing Source of Business (SOB).

Changes to Consumer Finance Commission Plans.

For new vehicles (including demonstrator vehicles) and all consumer other goods, the broker will be eligible for a Consumer Commission based on the following:

Where the broker discounts the Consumer Customer Rate for a particular transaction, the broker’s AFC for that transaction will be reduced based on the formula below:

Actual AFC = [1- (Consumer Customer Rate – Written Rate) / 2] x AFC

Worked Example:

Purchase of a new car for $40,000. The Consumer Customer Rate is 7.50% (set by ANZ).

Broker discounts Consumer Customer Rate by 100bps to 6.50%

Actual AFC = [1 – (7.50 – 6.50) / 2] x $1500 = $750

There are no changes to the commercial commission calculation.

Broker Origination Fee

For all consumer and commercial asset facility types, except leases, ANZ will finance a broker origination fee of up to $900 (plus GST). As this is a fee charged by the broker, the Broker will continue to have the discretion to charge a lower or higher amount or waive the fee altogether. However, the maximum amount that ANZ will finance will be $900 (plus GST), subject to change as notified by ANZ in the monthly writing plans.

Writing Plans and Calculator

From 1 December 2017, a new Consumer Writing Plan and calculator will be distributed. This will be in addition to the existing Commercial Writing Plan and calculator that are distributed monthly by ANZ.

Inflight transactions on consumer SOB

The following will apply:

- All consumer motor vehicle inflight deals approved and documented on or before 1 December 2017 and settled on or before 15 December 2017 will be covered by the existing commission and pricing plans.

- All consumer motor vehicle inflight deals approved but not documented on or before 1 December 2017 will need to be re-submitted to assessment for approved under the new commission and pricing plan.

- All consumer other goods inflight deals approved on or before 1 December 2017 and documented and settled on or before 31 December 2017 will be covered by the existing commission and pricing plans.

- All consumer other goods inflight deals approved on or before 1 December but not documented and settled on or before 31 December 2017 must be re-submitted and approved under the new commission and pricing plan.

- Pricing and commission calculations for commercial transactions will remain unchanged.

If you have any queries please contact your ANZ BDM to discuss. Alternatively each ANZ BDM will discuss the changes in their regular visits.